Frampton New Homes: the dream breaker

8 October 2013

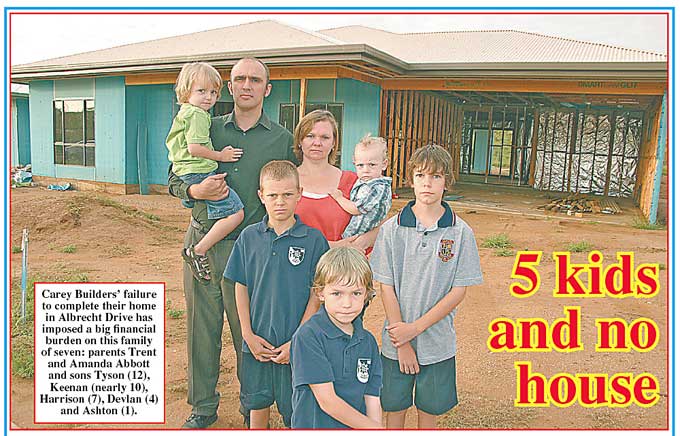

The Alice Springs News front page photo on March 18, 2010. Mrs Abbott was pregnant at the time and they now have six children. They were forced to sell the house.

UPDATED 4:05 pm – see bottom of the report.

By ERWIN CHLANDA

People under the illusion that our regulatory authorities would finally provide justice in the Frampton New Homes scandal were gobsmacked: it had taken more than two years to work out and needed senior legal opinion to get there, but the Agents Licensing Board had no power to make a ruling on alleged breaches of the Agents Licensing Act by real estate agents Frampton First National. And the reason? There was no “relationship of principal and agent” between Framptons and its customers.

The customers – the ‘principals’ – had bought their land-and-home packages from Framptons in 2008 and 2009, under a scheme known as Frampton New Homes. They had accepted on face value the agency’s assurances that it would be all smooth sailing from there, assurances made in printed material under the Framptons logo, quoting for correspondence their formal company name, Peter Norton Real Estate Pty Ltd and their ABN, and signed by their employee.

The customers had been told that Frampton First National would “be there at the Progress Inspections with the builder and lender to once again ensure your expectations are met. When the final installment is paid on completion, Frampton First National will ensure that the home is not signed off as being complete until you are totally satisfied with the result.”

But, when it came to the breaches of the rules of conduct for agents, alleged in five separate complaints from customers between 2010 and 2012, the law apparently had it that there was no customer to agent relationship, so the board had no power to act.

This ruling was made in November 2012. The reasons were not given until September 11, 2013. Sigh of relief, it was over, the board and everyone else was off the hook.

Not the little guys though, the customers of the failed Frampton New Homes scheme. Some of them at least are still working overtime to pay off their huge mortgages – driving taxis, nursing, working in administration, at the prison. For the Abbott family of eight, they have been forced to sell their home because they can’t afford the repayments. The little guys are not off the hook.

The Agents Licensing Board “inquiry” on September 11 was but the latest occasion when the little guys had been told, forget it, forget about being looked after by the law and the regulators. As they had feared when their new home dreams came tumbling down around their ears, more than three years later they were still on their own.

The best the board could manage was a “slap on the wrist” for Framptons for publishing misleading advertising. The advertising, according to the ruling on their complaints which was forwarded to the complainants and which one of them passed on to the Alice Springs News  Online, had “helped to create an environment in which the complainants and others felt reassured that Carey Builders Pty Ltd was a reputable builder who could properly undertake the building work and, as a result, they entered into those building contracts. (Carey is pictured at right.)

Online, had “helped to create an environment in which the complainants and others felt reassured that Carey Builders Pty Ltd was a reputable builder who could properly undertake the building work and, as a result, they entered into those building contracts. (Carey is pictured at right.)

However the Board accepted there were other factors [they don’t say what] that came into play between the publication of the misleading material and entry into the building contracts. Those matters fell beyond the limited scope of this Inquiry … Further, they prevented the necessary connection between the breach of the rules of conduct and the making of a profit, if any, by Framptons which would be required to trigger the Board’s powers … to order repayment of any such profit.”

The action on the lesser matter of publishing misleading advertising was proudly on the board’s “own initiative”, the chairperson, lawyer Suzanne Philip, was keen to have the ‘inquiry’ know.

Two days had been set aside for the so-called inquiry. In the end, a morning sufficed. Before the doors even opened there was a prepared “statement of facts” accepted by Framptons conditional on the board agreeing to a ruling that would amount to no more than a reprimand. If the board were to entertain a more serious course of action, then the accepted facts would be withdrawn and Framptons would be given the opportunity of contesting the allegations against them, relatively minor as they were.

No-one seriously thought the board was going to do that. They retired – long enough for a cup of tea and a biscuit or two – and then came back with the ruling that had been sought. Like the statement of facts, it had already been typed up and distributed before the ‘inquiry’ began. Oh, and just in case anyone thought the board was a patsy, they imposed an additional condition: that Framptons had to put in place processes to ensure they would never do anything of the sort again!

Philip at  least looked a little self-conscious and took pains to point out that the board had had the documentation for some time. They weren’t just pretending to have read it.

least looked a little self-conscious and took pains to point out that the board had had the documentation for some time. They weren’t just pretending to have read it.

She also felt obliged to again explain why the board hadn’t been able to take action in relation to the earlier complaints of breaches of the rules of conduct. We had already heard from counsel assisting the board, Alistair Wyvill, a version of events that made what had happened to the homebuyers sound like it had all been hatched between builder Randal Carey and Framptons’ junior employee Jeff Hardyman. It was especially Hardyman who had “oversold” Carey, in Wyvill’s version; it was Hardyman who had helped Carey hide his de-registration from the customers.

Now we heard about Hardyman again from Philip. He was not a licensed agent under the Act and therefore the board couldn’t do anything about him and his activities. There was no explanation of why the buck didn’t stop with his employers, who are licensed agents. Their names, Andrew Doyle (below, at left in the photo, pictured with fellow real estate agent Eli Melky. Doyle is handing out how to vote cards for Melky at last year’s town council elections SEE CORRECTION) and David Forrest (above left), were never mentioned, not once. The fact Hardyman was an agent in training clearly made his supervision doubly important, and the responsibility of his bosses, more direct.

Both Framptons’ directors continue to operate their business, Doyle, in Alice Springs, Forrest, in Cairns where he operates First National Cairns Central, and enjoys the golf and fishing, according to Framptons’ website.

Both Framptons’ directors continue to operate their business, Doyle, in Alice Springs, Forrest, in Cairns where he operates First National Cairns Central, and enjoys the golf and fishing, according to Framptons’ website.

The “enormous stresses and losses” of the victims were acknowledged. But in the next breath the “cooperation of Framptons in recent weeks, once the true allegations were known” was also acknowledged.

Four of the home-buyers attended the inquiry. Now they were told that their “remedies” were in the civil court or with Australian consumer legislation. These are ordinary working people who have sustained losses in the hundreds of thousands. Giving only the examples of those who attended the hearing: the Abbotts, who have six children, had to raise an additional $210,000 to complete their home, borrowing $160,000 of it on Trent Abbott’s single income. For Alan Fisher and Denyse Thornton, both in their sixties, it was an additional $180,000; for the Iveses, an additional $100,000. Little wonder that to date the home-buyers have hesitated to fund their own legal action. “We wish you the very best,” said Philip.

Not surprisingly, they were angry and two of them had the courage to speak up in the hearing. Alan Fisher told the board that it was a “toothless tiger”. His partner Denyse Thornton wanted to know whether the maximum fine available as a penalty under the Act, $7000, could not be multiplied by the number of victims of the “misleading advertising” that Framptons were being reprimanded for.

The board “could see no value in a fine”, said Philip. Fisher and Thornton, who have had to postpone their retirement so that they can keep working to pay off their home, could be forgiven for not agreeing.

To date, none of the victims has received a cent of compensation. After Randal Carey – actively promoted by Framptons who had a commission deal with him, additional to the land sales commission they received from their clients – fell over, Framptons offered no help, neither money nor in kind assistance.

The issue is gaining further currency as a review is under way into the NT Government’s new scheme for protecting home buyers when builders default.

In the Frampton New Homes scheme the real estate agency’s directors, Doyle and Forrest, suggested that they too were victims. Alan Fisher in a signed statutory declaration, dated June 27, 2011, says he and Thornton met with Framptons’ bosses Doyle and Forrest after the collapse of Carey Builders: “We expected at least to be refunded the commission we knew Mr Carey was obliged to pay them but they refused, claiming Framptons had not been paid by Carey.”

This is in conflict with the accepted facts put before the Agents Licensing Board, in which Framptons admitted that the firm was to be paid “a disclosed commission” by Randal Carey of $8800 per house or 3.3% of the contract price whichever was greater.

When I raised that deal between Carey and Framptons during the defamation action Forrest took against me in 2011, on the basis of paperwork I had obtained during the discovery process, it was dismissed as an “unsigned” agreement. Now it emerged as a fact.

Carey’s lawyer Peter Maley in the Supreme Court sentencing hearing said his client had paid Framptons the “lion’s share” of the first installments he received from the home-owners, estimated at $100,000 in total. Frampton’s legal representative Peer Schroter says the amount was “significantly less” than this – that can mean nothing other than some amount of money was received.

The Supreme Court ordered Carey, currently serving three years (to be suspended after one) for his offences of deception, to pay the victims $5000 each but whether that will materialise is another question.

Although the Supreme Court action against Carey and the statements made by Maley on his behalf raised questions of criminal court action being taken against Framptons, it is now clear that this won’t be happening. On September 16 police made this statement to the Alice Springs News Online: “Southern Investigation Detectives have completed an investigation into the conduct of Framptons First National Real Estate and liaised with the Department of Public Prosecutions. At this time no criminal offences have been identified against Framptons.”

We know little about the scope of that investigation. We do know this, however: one of the detectives given the assignment was also the detective in the original investigation that had pinned all the blame on Carey.

As we have said, the victims – the description used by Justice Jenny Blokland, who sentenced Carey – have yet to decide on taking civil action against Carey or Framptons or both. Justice Blokland referred in her sentencing remarks to one victim, Blythe Stafford, telling the court that she would like Carey to receive a reduced prison term in return for “full cooperation and full disclosure in assisting to pursue a civil action against Framptons who she holds responsible as well”.

Stafford, a leading figure in the Frampton New Homes Broken Promises Group, was the first to formally complain about Framptons. She wrote to the Registrar of Land, Business and Conveyancing Agents on June 10, 2010, setting out allegations of breaches by Framptons’ of the rules of conduct by agents, such as exercising “due skill, care and diligence” on behalf of “the principals” (customers). As I’ve said, she waited until September 11, 2013 – three years and three months – to get a response.

In the absence of any legal action “on foot” I am now putting before you, the public, further critical information about this whole saga, most of which has not previously been published.

I will present only the most salient of the facts I collected reporting the events from the beginning, and defending, without legal representation which I couldn’t afford, the defamation action brought by Forrest against me. That action, as I reported at the time, resulted in an order by Justice Judith Kelly to pay Forrest damages of $100,000 – the maximum, as I understand it – plus costs. I have declared myself bankrupt. Forrest is my only creditor.

This is in contrast to the situation of Forrest when a company of which he and his wife Carroll were directors was put under a deed of arrangement, in the wake of the collapse of Territory Tool and Gun Company, a hardware and building supply firm. As we reported on March 28, 2001 and on April 4, 2001, the report by KPMG into Tool and Gun’s operating company, Jayford Pty Ltd, revealed that it owed more than $1.4m to 138 unsecured creditors, including $40,000 to staff and more than $44,000 to a local plumbing firm.

So, can Jeff Hardyman fairly be left to carry the can for Framptons in this debacle? Carry it morally, I mean. I’m not aware that any action is being taken against him.

Hardyman accepted an “employment offer” signed by Forrest on January 23, 2008. His income would be on commission only – Framptons as the listing agent would get 60% and he’d get 40% of the commission on land-and-home packages they were marketing as Frampton New Homes.

Hardyman did not have an Agents Representative License and was required to obtain one. He was thus a trainee, someone who could operate as he was in the industry only under the supervision of licensed agents, in this case Forrest and Doyle.

In my research I had contact with eight of the 12 victim families. It is true that they dealt primarily with Hardyman, but in statutory declarations, submitted to the Supreme Court in the course of the defamation case against me, they say that they bought into the New Homes scheme because of Framptons’ status as a prominent and, they believed at the time, professional real estate agency.

The situation was not traveling well by early 2009. A local plumber, Jason Flavell, to whom Carey Builders owed about $91,000, was getting worried that he’d never see it. He says, in a statutory declaration dated September 3, 2011, that he tried to get Framptons to intervene. In February 2009 he was in their office several times, he says, speaking to Forrest. And during these discussions he told Framptons that Randal Carey and his company Carey Builders did not have current registration in the Northern Territory as builders.

Forrest was vague about this when I questioned him during the defamation action. He said he could remember meeting him, but not when: “It’s a long time ago.”

Chlanda: Now he told you, amongst other things, that Mr Carey was not registered, did he not?

Forrest: I can’t recall what he said. I think he talked about the fact he wasn’t being paid.

Flavell would certainly have been expressing his concerns forcefully and he wasn’t limiting his appeals for action to Framptons. He’d communicated with ASIC, Contractors Accreditation Limited, and the NT Builders Licensing Board, among others.

I asked Forrest whether he had told his clients that Carey was not registered.

Forrest: I personally didn’t, no.

Contracts were still being signed in the Framptons office as late as March 25 and 31. 2009. The contracts were between Carey Builders Pty Ltd – whom Framptons knew was unregistered from “early 2009”– and customers, David and Marietta Ives on March 25, and Samantha and Nicholas Williams on March 31.

Can all this be brushed aside as the fault of a junior employee?

Further, payments of large amounts of money were continuing to be made to Carey Builders by customers who had been assured that in return for their commission fee to Frampton First National that firm would “oversee the entire project from start to finish”.

The Abbotts, for example, made $261,774.50 in payments from October to December 2009. They were never given any advice or warning about Carey even though there had continued to be expressions of consternation over the status and performance of him and his company coming into the Framptons office.

These were payments from which Framptons stood to get a commission from Carey, or may actually have received a commission. We know they did receive some payments in commission from Carey.

Most or all of the victims:-

• did not know Carey before being introduced to him by Framptons;

• believed their use of Carey was a condition of the scheme;

• were not presented with any alternative builders;

• signed the contract with Carey Builders in Framptons office;

• had Framptons employee Jeff Hardyman nominate himself as the applicant for the building permit.

We know that on May 13, 2009 Jaqueline Blom, working in the real estate industry herself and acting on behalf of a family trust, emailed Hardyman saying in part: “As the Building contract was [with] Carey Builders Pty Ltd … who are currently not registered, we wish to cancel our building contract.”

We know that the Williamses, who had only signed on March 31 and had paid a deposit of $13,990, also found out in May that Carey Builders weren’t registered. On May 11 they wrote to Carey and demanded their deposit back. They’re still waiting.

This was valuable business going out Framptons’ door. All being left to a junior employee to handle? That word again, gobsmacking.

We know, from a statutory declaration dated July 4, 2011, that building certifier David Cantwell met personally with Andrew Doyle in his office on May 20, 2009. The purpose of the meeting was to discuss the changed arrangements allowing Carey to continue on site as “project manager” under the supervision of Darwin-based registered builder Damien Golding. Doyle was “extremely concerned”, says Cantwell. Why, you may well ask?

The switch of builders required the consent of the buyers. None of them had been told about the switch, least of all by Framptons. Most of the buyers only found out about Golding when Carey Builders fell over in March 2010.

Hardyman was at the meeting between Cantwell and Doyle. Cantwell says he recalls telling both men to advise all Framptons’ clients of the changes. He recalls Hardyman saying he would see to it. Again, the “extremely concerned” Doyle, while the firm was losing business, left it to a junior employee to put everything right? And there were no more questions to ask?

Framptons employee Hardyman – knowingly or unwittingly – played a significant role in the unauthorized substitution of another builder.

Hardyman told the police in a statutory declaration on June 23, 2010 that all clients signed with Carey, no other builder. “I was a witness to all of these contracts and signed them also.” The signing took place in Framptons’ office.

“I assisted Randal [Carey] and the client by filling out the first and third page of the three page document. Randal asked me to keep the second page blank because he would record his details here later.”

It transpired that Golding’s name was inserted on page two, without the knowledge and consent of the victims.

Hardyman said in his stat dec: “At all times I believed that Randal Carey was the builder and contracts had been signed as Randal Carey recorded as the builder. I had no knowledge at the time that Randal had actually lost his building licence.”

Framptons, through Hardyman, took a leading role in submission of formal paperwork. His signature appeared on – at least – two forms called “Evidence of Building Contract” dated April 27, 2009; and as the applicant for three building permits dated April 21 and 23, and March 6, 2009.

Buyers I spoke with regarded that as part of Framptons’ undertaking that they, the customers, would be “totally satisfied” at the end of the purchase and construction process.

They thus reasonably expected that he would ensure the paper trail was always up to scratch. Yet when builders were switched, a vital element was missing: no-one from Framptons ensured the buyers’ written consent was obtained.

I asked Forrest during the defamation action, whether around May 2009 he had discussed a change of builder with any of the Frampton New Homes clients. This was referring to the arrangement that the unregistered Carey carry on working under the supervision of Golding. Had he discussed this with the clients?

Forrest: Me personally?

Chlanda: I’m sorry?

Forrest: Me?

Chlanda: You personally.

Forrest: No. No, not that I recall.

Chlanda: Were you personally aware that Mr Golding had been appointed as the builder at that time?

Forrest: Yes.

There was another thing that the Framptons bosses didn’t tell their clients and they can’t pass this one off onto Hardyman. When the scheme began they decided to build a display home and, through their family trusts, employed Carey to do the work. Doyle and Forrest made progress payments on the work from mid-2008 to February 19, 2009.

In early 2009 they heard “rumours” that Carey wasn’t licensed and had a meeting with him. I know this from having been allowed, in the course of Forrest’s defamation action against me, to tender in evidence Doyle’s statutory declaration to the police in which he outlines this situation. He said Carey assured them that he had submitted paperwork to renew his registration but it was taking longer than expected and that meanwhile he was “legally building under another builder”.

Doyle said he and Forrest contacted the certifier who told them that the situation Carey was in with another builder “was perfectly legal”.

But meanwhile progress  on the display home had slowed. Doyle said: “Randal was unable to finish it as he was contracted to do.” He and Forrest withheld the final progress payment, worth 5% of the original contract, and putting in extra money, organized alternate tradespeople to finish the job.

on the display home had slowed. Doyle said: “Randal was unable to finish it as he was contracted to do.” He and Forrest withheld the final progress payment, worth 5% of the original contract, and putting in extra money, organized alternate tradespeople to finish the job.

They do not appear to have told any of their existing clients of this experience with Carey. Not the new clients either. How keen would any of them have been to go with Carey of they had known of it? Wouldn’t they have then asked to see some of the other quotes from the panel of builders promised by the New Homes scheme?

As I’ve said, the Iveses signed their contract on March 25. While a panel of builders had been mentioned in the “Frampton New Homes Design and Purchase Procedure,” Dave Ives in a statutory declaration dated July 11, 2011, says: “We were not introduced to any other builders nor were we shown any other quote. The Carey Builders quote was recommended to us by Jeff Hardyman.”

This is consistent with the experience of all the victims we had contact with. They were all told there was a panel of builders to choose from but were only ever given one quote, Carey’s. While some had signed contracts before early 2009, for many, work on their houses had not begun. They could still have pulled out and minimized their losses. The Abbotts, for example, did not get title to their land until October 2009.

Building work for Fisher and Thornton (below right) did not start until October 2009. Work for Christopher and Rebekah Axe (above, left) only began in March and had stalled by July. They only managed to minimize their losses by a family member, a qualified builder, completing their home without charging for his labour.

After “early 2009”, when the Framptons bosses knew of Carey’s registration problems and when they had had their own less than satisfactory experience with Carey’s performance and dropped him, they allowed the scheme to continue, leaving their clients in the dark.

After “early 2009”, when the Framptons bosses knew of Carey’s registration problems and when they had had their own less than satisfactory experience with Carey’s performance and dropped him, they allowed the scheme to continue, leaving their clients in the dark.

I asked Forrest about this during the defamation action.

Chlanda: You did not tell any Frampton New Homes clients about your experiences with Mr Carey, did you? At least not until about the time when Carey Builders went into liquidation [March 2010]?

Forrest: I probably couldn’t answer that in its entirety; I may well have.

Chlanda: You have or you haven’t?

Forrest: Well, I think in conversation; I can’t recall every conversation I had with all those people but I couldn’t say I definitely didn’t, no.

Priti Easo and husband Biji Samel were clients of Frampton New Homes. They were proud to be the first people of Indian origin to build a home in Alice Springs. She can recall a conversation she had with Forrest. She says in a statutory declaration dated July 4, 2011 that in “about mid 2009 we raised with Mr Forrest the fact that there was no progress with our house. He did not apologise for the delay but said he was happy to buy back the land.”

Easo can recall another conversation too. After Carey Builders collapsed, she and her husband spoke with both Forrest and Doyle who told them, she says in the same statutory declaration, “that they had a house built by Carey Builders in 2008. They terminated their arrangement with Carey Builders before it was finished because they were dissatisfied with the company’s performance.”

She told me: “Neither Mr Forrest, Mr Doyle nor Mr Hardyman informed me about this experience with Carey Builders Pty Ltd at the time we signed our contract with Mr Carey nor when construction was due to start.”

Carey poured the slab for Easo and Samuel’s house in June 2009. Between then and December 2009 this hard-working young migrant couple, expecting their second child, went on to pay $195,510 to Carey, on a contract worth $205,800. For that, they got a half-built house and needed to raise a further $100,000 to finish it. They couldn’t get a loan so they work around the clock, hiring tradespeople as they can and as funds permit.

Several victims gave me stat decs saying they would have cancelled the contract with Carey had they known he was unlicensed.

By mid 2009 the alarm bells about Carey were starting to go off in the public domain. Subbies had already raised concerns that they were not being paid, which the Alice Springs News reported on May 14. On June 4, 2009, the News reported that Carey was unlicenced and bankrupt. Yet the Frampton New Homes scheme would go on for almost another year.

The department was apparently taking action but would not comment. We all know how effective that action was! The victims would go on bleeding money until March of the following year when Carey Builders fell over taking the Frampton New Homes scheme and most of its hapless clients with him.

But Framptons bosses were able to get right back up, shake off the dust and keep going.

This is what they say, in part, about their agency: “We maintain the highest ethical standards and are members of the REINT. We are the only Real Estate company in Alice Springs to be accredited with Best Practice Quality Assurance. This is a guarantee of service to a predetermined and written standard for every part of the real estate process.”

You be the judge.

FOOTNOTE: The defamation suit brought against me by Forrest has been mentioned only in passing. This report is not about me, but about the victims, the conduct of a significant local company, and the government regulators, including the police. However, I’m happy to respond to individual requests for information. I believe that the way defamation is being handled by the legal system is one of the greatest obstacles to the freedom of the press in this country. Erwin Chlanda, Editor.

We received the following from Povey Stirk Lawyers & Notaries, representing Framptons:

As you are aware we act for First National Real Estate Framptons. We are instructed to provide this response pursuant to your right of reply request yesterday of our client in relation to your proposed publication, only on the basis that it is published in its entirety.

Our client’s position is that:-

1. The Agents Licensing Board has carried out its statutory functions with respect to investigations against our client in accordance with the law, assisted by its investigative staff and senior legal Counsel,

2. The Northern Territory Police as the appropriate authorities have investigated whether our client has committed any criminal activities, liaised with the Department of Public Prosecutions, and they have expressly advised you that no criminal offences have been identified against Framptons,

3. Your article mischievously implies that those police investigations may be tainted because “one of the detectives given the assignment was also the detective in the original investigation that had pinned all the blame on Carey”,

4. At all times our client has fully cooperated with all enquiries and investigations of relevant authorities, including the Police which has culminated in the conviction of Mr Carey.

5. If the multitude of claims and innuendos in your article are to have any valid basis, there are no better venues for them to be tested and verified than in the various authorities, courts and tribunals appropriately qualified and authorised according to law to determine these matters.

Alternatively, your readers may wish to rely on the basis of what is written in the Alice Springs News (that has previously given rise to untrue and defamatory comment, which Mr Chlanda expressly agreed in the course of the successful defamation trial, constituted a serious breach of basic journalistic standards).

As your article concludes “you be the judge”.

PEER SCHROTER | LAWYER DIRECTOR

POVEY STIRK Lawyers & Notaries

We read your comprehensive summation of the disastrous events known as the Framptons New Homes and pass on our thanks. The Alice Springs News’ tenacity in continuing to support the victims of this scheme and to report on the immediate and long term impact on their lives earns our gratitude and appreciation.

The “gob smacking” truth is that the tribunal accepted that Framptons should be allowed to dictate their own punishment.

A reprimand! We felt that a maximum fine imposed for each affected family, would go some way to indicating that the tribunal did not condone the retention of “commission” monies by Framptons. However this punitive action was apparently considered inappropriate.

We are deeply saddened that Trent and Amanda Abbott have lost their home after three years of struggle. Our hearts go out to them. They have suffered unimaginable personal hardship and grieve for what “might have been” for this family.

Perhaps in the early days, had Framptons shown any compassion for our misfortune, a gesture of good will like returning our commission monies and/or assistance in sourcing alternative builders to complete our homes, gestures which may have changed lives for the better both then and now.

As we move forward, our plans for civil action against Framptons continue in 2014.

Our thanks again for your informative and supportive reporting.

Denyse Thornton and Alan Fisher.